Are you interested in a GCash insurance review?

Now that more and more countries are easing their restrictions for international travel, it’s more important than ever to avail a travel insurance as a Filipino tourist.

We all want to be safe, after all. 🙂

In this post, we share our experience of buying GCash travel insurance with COVID benefits, how much it costs, and what are the actual GInsure benefits when you get your insurance from the app.

What is GCash Insurance?

GCash Insurance, or GInsure, is a one-stop-shop for all your insurance needs located in the GCash app.

It offers different types of insurance like life insurance, health insurance and travel insurance. But for this GCash insurance review, we’ll focus on GCash travel insurance only.

GCash Travel Insurance Review – Benefits

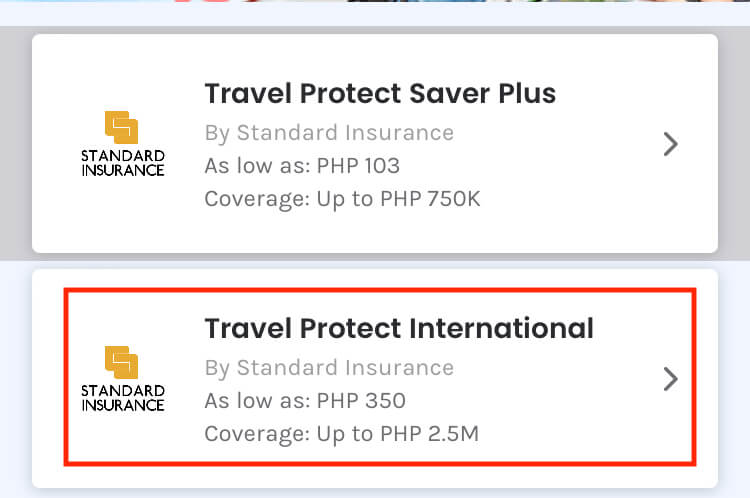

GCash partnered with Standard Insurance to offer 2 types of travel insurance: Travel Protect Saver Plus and Travel Protect International.

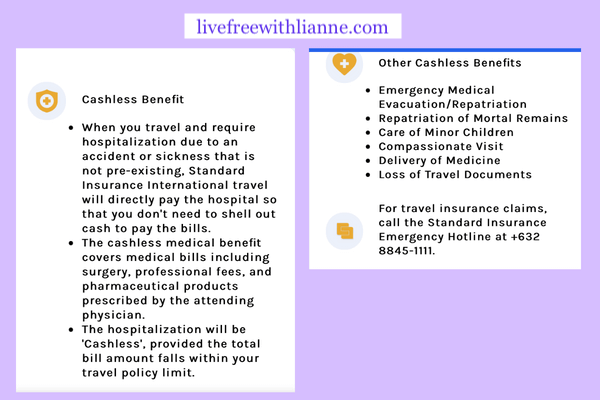

Both are serviced by Standard Insurance. The reason why Travel Protect International is more expensive is because it’s a cashless travel insurance plan.

This means that if something happens and you’d need to avail the insurance benefits, you do NOT need to shell out any cash — it’s cashless so the plan will take care of the benefits on your behalf.

Gcash Travel Insurance with COVID-19 Benefits

Speaking of travel insurance benefits, what coverage will you have if you get the Travel Protect International plan?

With your GCash travel insurance plan, you can get covered in case of:

- Emergency Medical Treatment including claims due to/arising from COVID-19

- Personal Accident benefit

- Emergency Travel Assistance

- Travel Inconvenience

- Trip Cancellations including claims due to/arising from COVID-19

How to Avail GCash Insurance

How can you get a GCash travel insurance?

A GCash insurance review wouldn’t be complete without instructions on how to avail the travel insurance from GInsure, so here’s how you can buy it online.

1. Click Travel Insurance

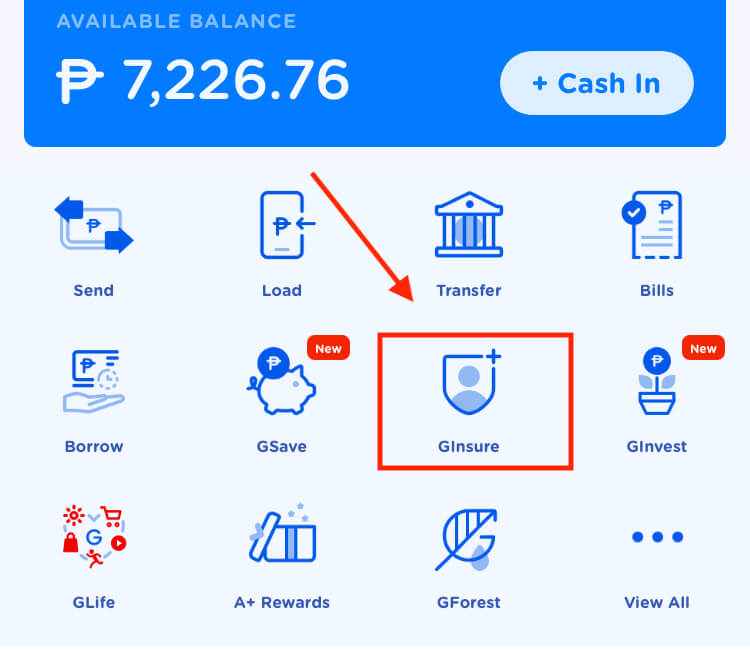

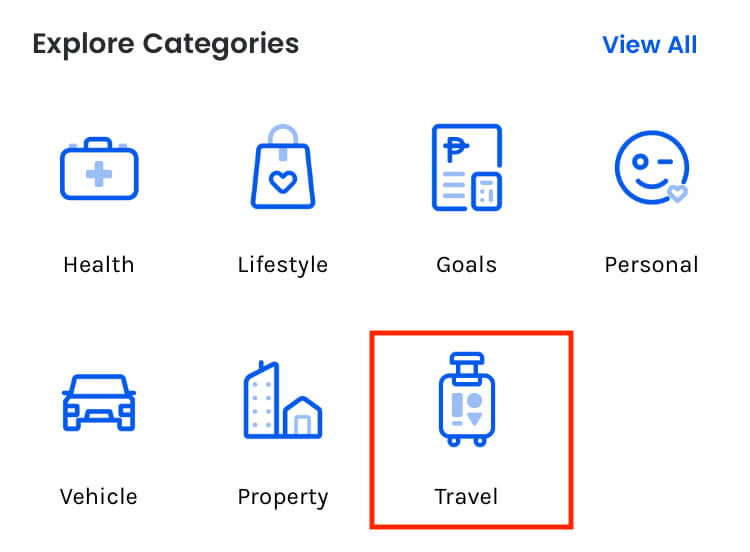

First, log into your GCash app. Click on GInsure at the main menu.

You’ll be asked to choose from different insurance categories. Tap on Travel so that you’ll be directed to the travel insurance options.

Here, you can choose from Travel Protect Saver Plus and Travel Protect International.

Personally, we chose Travel Protect International because we didn’t want to use our own money if ever something happened. It’s better to choose a cashless plan so there’s still peace of mind when getting travel insurance.

2. Review the Travel Insurance Benefits

Next, you’ll find out about the insurance benefits of your travel plan.

For example, since Travel Protect International is cashless, this means the insurance company will directly pay the hospital so you don’t need to shell out cash to pay your medical bills when travelling.

If you want to know how to claim GCash insurance, you’ll also find out in this step.

For example, if you have a Travel Protect International plan, you just need to call the Standard Insurance Emergency Hotline at +632 8845-1111.

Read the travel plan benefits, then tap on Agree so you can go to the next step.

3. Fill Out Your Personal Information

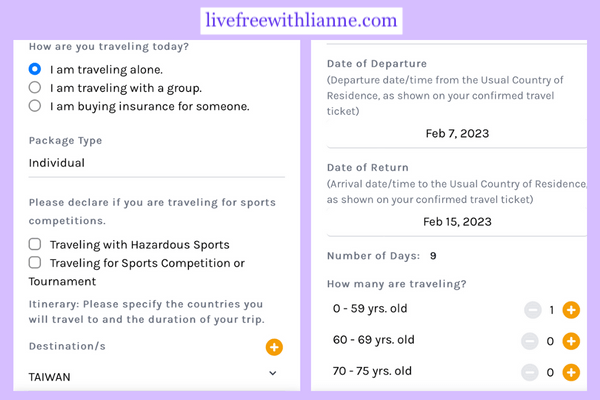

To continue buying your GCash travel insurance, you need to fill out your personal details in the GCash app.

Based on the details you put, GCash will calculate your travel insurance premium.

For example, for a 9-day travel stay in Taiwan, it costs ₱569 for coverage for one person. It’s a bit cheaper compared to my Pacific Cross travel insurance for Thailand travel.

4. Check Your Travel Policy Benefits

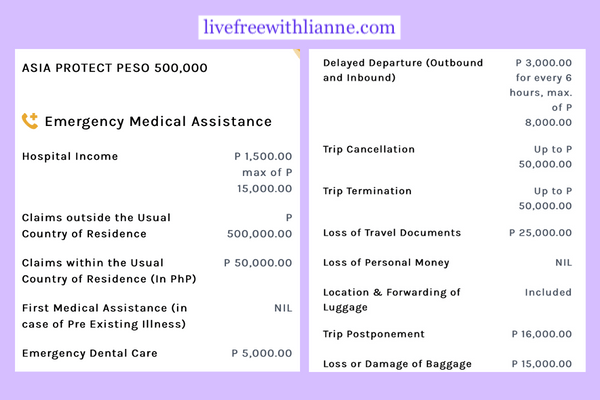

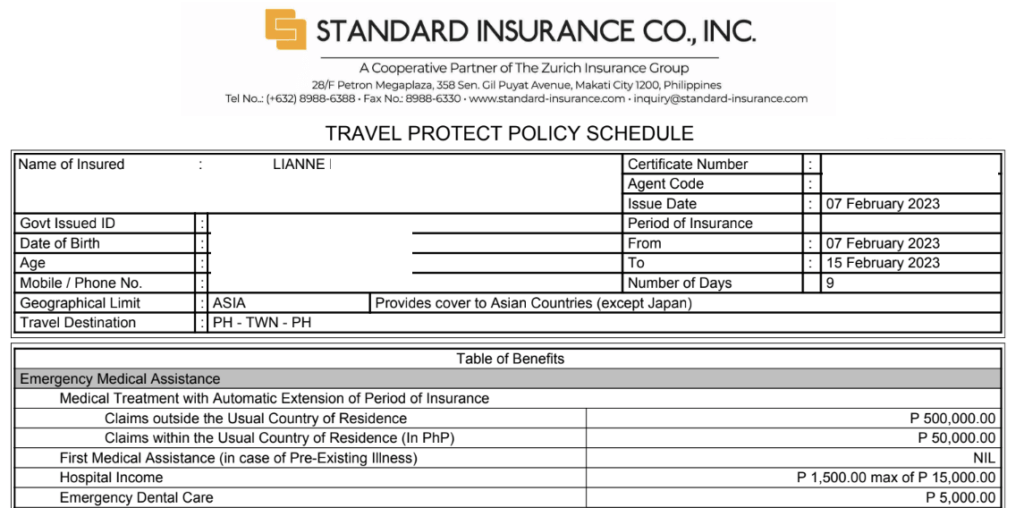

For our Taiwan trip this 2023, we chose the Asia Protect 500,000 coverage under Travel Protect International insurance plan.

Here’s some of the benefits I like about it:

- Emergency medical benefits including claims arising from COVID-19 for up to ₱500,000

- Hospital income – ₱1,500 hospital income per day of hospitalization

- Emergency dental care – ₱5,000

- Loss or damage of baggage – ₱15,000

- Trip cancellation – up to ₱50,000

You can see the full details of this travel insurance plan below.

Even if you’re already vaccinated against COVID-19 and you already have your VaxCert PH, it’s still reassuring to have a travel insurance plan in place so you’re protected.

Want to know how to pay travel insurance in GCash? Let’s go to the next step below.

5. Pay Your GCash Travel Insurance

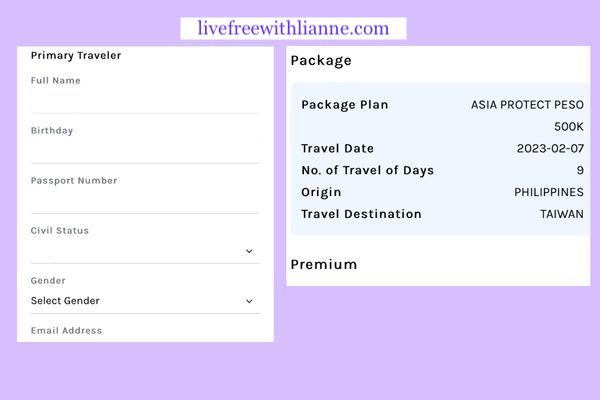

Finally, you just need to enter your full name, birthday, passport number, civil status, gender and email address in the next section.

Tap on Pay and GCash will deduct the travel insurance premium from your GCash balance. Other travel insurance plans like Pacific Cross lets you use your credit card for payment, but for GInsure travel insurance, it’s just the balance.

And that’s it, you’re now insured!

You can click on View Travel Certificate to see your GInsure travel insurance plan.

Or you can check your email — your Policy Contract and other Policy Documents are sent immediately to your policy owner’s email address, like this:

Is GCash Insurance Worth It?

As you can see in this GCash insurance review for travel insurance, you only need to pay around ₱569 to have a ₱500,000 travel insurance coverage plan with GCash, depending on the benefits and the country you’re going to visit.

If you’re travelling internationally like in Thailand, Korea, Singapore or other countries abroad, a GCash travel insurance like Travel Protect International is definitely worth it.

Want to travel to Japan? Here’s how I got a multiple-entry tourist visa in Japan with no ITR.

Going on a trip soon? Check out the best credit cards for travel here.

⭐ Travelling soon? Get a Klook discount when you use LIANNEKLOOK

⭐ Watch my Travelling Tita Tips on @livefreewithlianne at Instagram

⭐ See my travel hacks and guides on @livefreewithlianne at TikTok

Live free,

Lianne